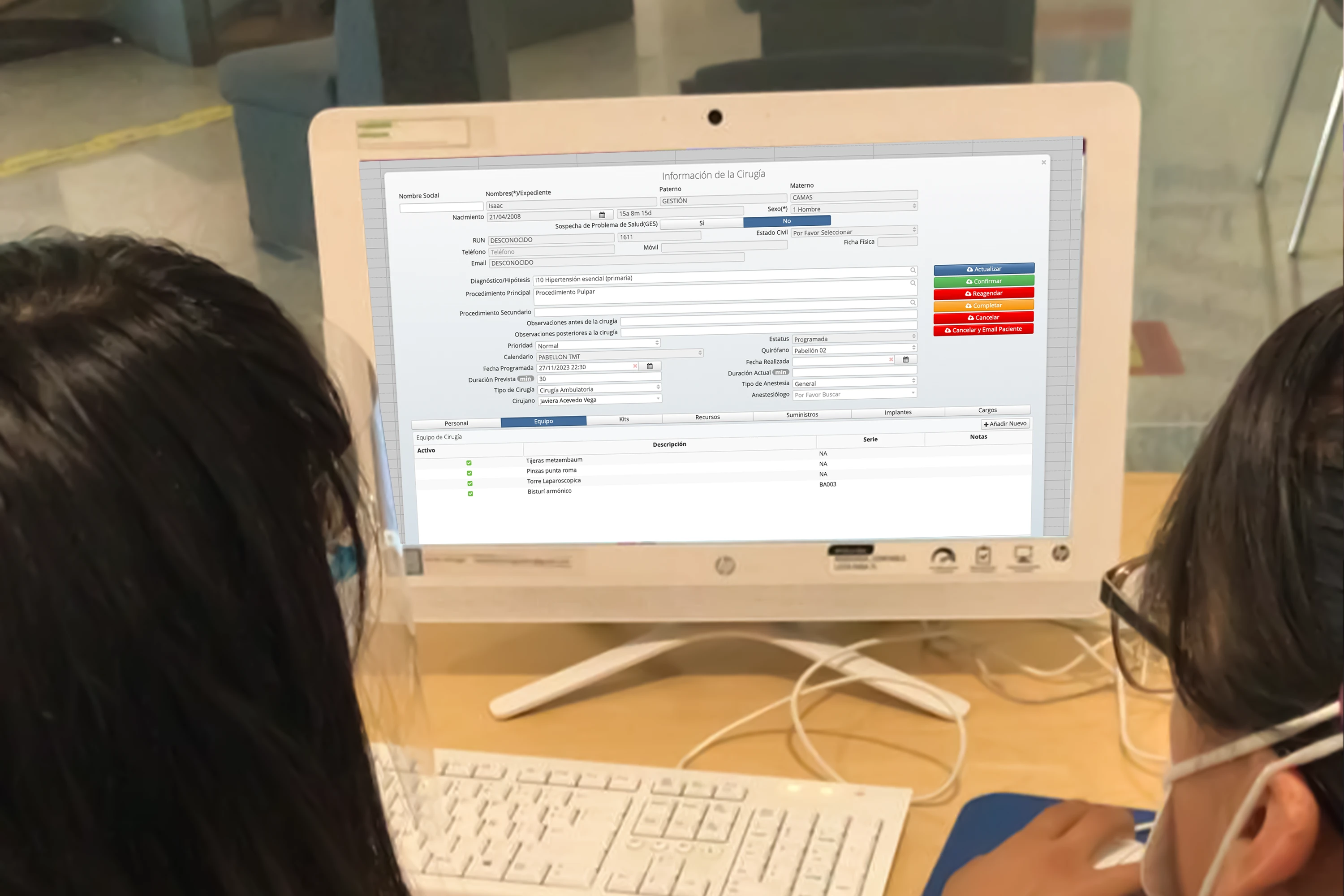

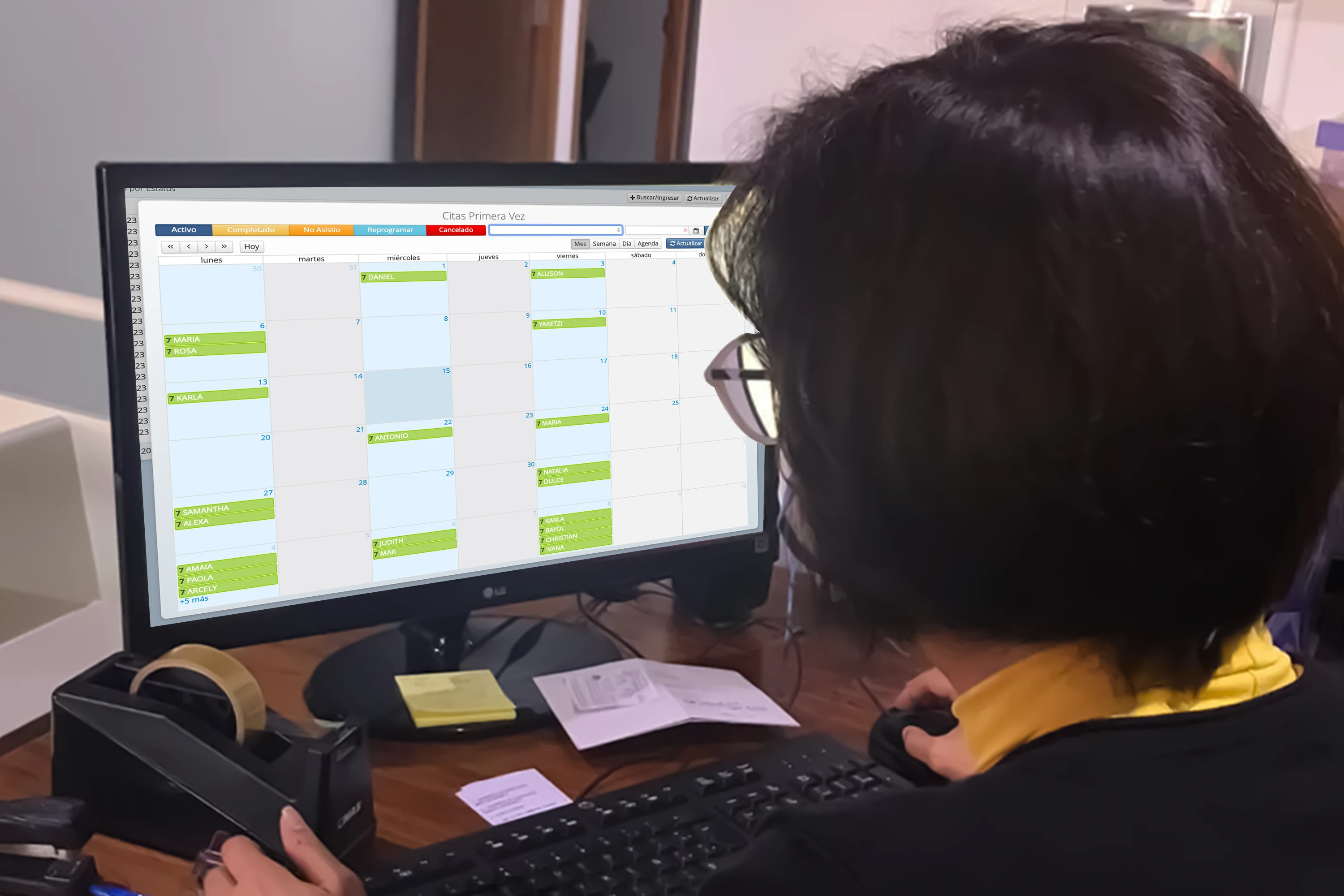

Optimización, control y reportes en cada aspecto de la Gestión Hospitalaria sin importar el tamaño de los recursos. Solución innovadora de gestión hospitalaria, diseñada para impulsar la eficiencia y calidad en la atención médica de hospitales de pequeña y mediana escala. Solución avanzada y personalizable de gestión hospitalaria, destinada a transformar y optimizar las operaciones de hospitales de gran escala y alta especialidad. Más de 25 módulos con funcionalidades específicas integrados en ambas soluciones. Con HarmoniMD se logra una gestión eficiente e integral de todo un hospital. 1. Módulo de Compras La gestión hospitalaria se basa en datos, pero no solo en la recolección de ellos, sino en la habilidad de interpretarlos correctamente. Este módulo permite la creación de reportes especializados, su análisis y la utilización de la herramienta de Business Intelligence. Brindamos personalización del 100% de los documentos clínicos electrónicos y administrativos, y ofrecemos flexibilidad para adaptarse a las necesidades específicas de cada hospital. Gracias a informes y visualizaciones intuitivas, los responsables identifican tendencias, hacen proyecciones y toman decisiones estratégicas basadas en datos reales. HarmoniMD asegura que los hospitales cumplan con estándares nacionales e internacionales relativo a registros y trazabilidad clínico médica y de manejo de datos de pacientes. Las herramientas centradas en el paciente aseguran una atención de alta calidad, facilitando el acceso a historiales médicos, tratamientos y otros datos relevantes. Los profesionales de la salud y administradores tienen acceso en tiempo real a información crucial, permitiendo decisiones informadas sobre la marcha. La plataforma mejora la eficiencia operativa, minimizando redundancias, agilizando flujos de trabajo y reduciendo tiempos de espera. Con un expediente clínico electrónico completo y la administración segura de medicamentos, se minimizan errores. Módulos de contabilidad y cuentas que aseguran crecimiento sostenible. En HarmoniMD somos reconocidos como uno de los mejores Expedientes Clínicos Electrónicos en el mundo. Basado en la investigación de Black Book, que clasifica los mejores registros de salud electrónicos a nivel mundial, HarmoniMD® es el sistema de registros de salud electrónicos número uno en México para 2020. En HarmoniMD hemos demostrado nuestra capacidad y alcance global al tener activas más de 122,000 facturas, gestionado más de 37,000 órdenes de compra y supervisado más de 3,000,000 transacciones de inventario. Además de encontrarnos en 7 países, consolidando nuestra posición como líderes en la gestión hospitalaria. Hospital FUCAM en la Ciudad de México Conoce cómo el Hospital FUCAM en la Ciudad de México haciendo la transición de un sistema completamente basado en papel al el Sistema Informático de Salud HarmoniMD®. «Ayuda a gestionar el flujo de trabajo crítico. Esto ha mejorado la calidad de la atención y la eficiencia con más de 1,000 pacientes que atendemos por día. Mientras tanto, nos ayuda a reducir costos y, por supuesto, a salvar más vidas.» «HarmoniMD nos ha ayudado a optimizar procesos internos, clínicos y administrativos, lo que ha generado una mayor eficiencia operativa y un mayor control de los recursos de la institución. Además, hemos recibido asesoramiento y apoyo de todo el equipo de HarmoniMD, lo que nos ha permitido seguir ofreciendo nuestros servicios de alta calidad.» «HarmoniMD es la solución que nos permite proporcionar una mayor calidad de atención a los pacientes, además de lograr rentabilidad financiera en la gestión hospitalaria.» «Recomendamos encarecidamente HarmoniMD, no solo es una solución que nos ha ayudado a estandarizar y mejorar nuestras operaciones, sino que también nos ha brindado el apoyo y la asesoría necesarios para asegurar la continuidad operativa del sistema.» Conéctate con nosotros y descubre cómo podemos revolucionar tu gestión hospitalaria. Soluciones

Módulos para cada solución

2. Módulo de Almacenes

3. Módulo de Cuentas por Cobrar

4. Módulo de Cuentas por Pagar

5. Módulo de Facturación y Caja

6. Módulo de Contabilidad

7. Módulo de Mantenimiento de Equipos Biomédicos

8. Módulo de Presupuestos

9. Módulo de Gestión de Aseguradoras y Convenios Conoce por qué HarmoniMD es el indicado para administrar todos los aspectos de la atención y gestión clínica

Personalización y Flexibilidad

Toma de Decisiones Basada en Datos

Cumplimiento de Normativas y Estándares

Mejor Atención al Paciente

Accesibilidad Móvil

Optimización de Procesos

Reducción de Errores Médicos

Control Financiero

Galardonados con distinciones en innovación y excelencia médica

Nos emociona apoyar a clínicas y hospitales, tanto que nuestros números nos respaldan.

—Nuestros casos de éxito

Empresas de transformación: nuestros casos de éxito

—Testimonios

Conoce lo que nuestros clientes opinan.

Maria Luisa Guisa

CEO - Fundación de Cancer de Mama

Cynthia Ortiz

CEO - Obesity Control Center

MD. Gustavo Liy

COO - Centro Oncologico Internacional

Maria Sol Mendieta

CEO - La Misión, S.A.

¡Transformemos juntos el futuro de la salud!

Lee las últimas noticias.